Swaprum DEX Team Vanishes in Apparent $3 Million Exit Scam on Arbitrum Network

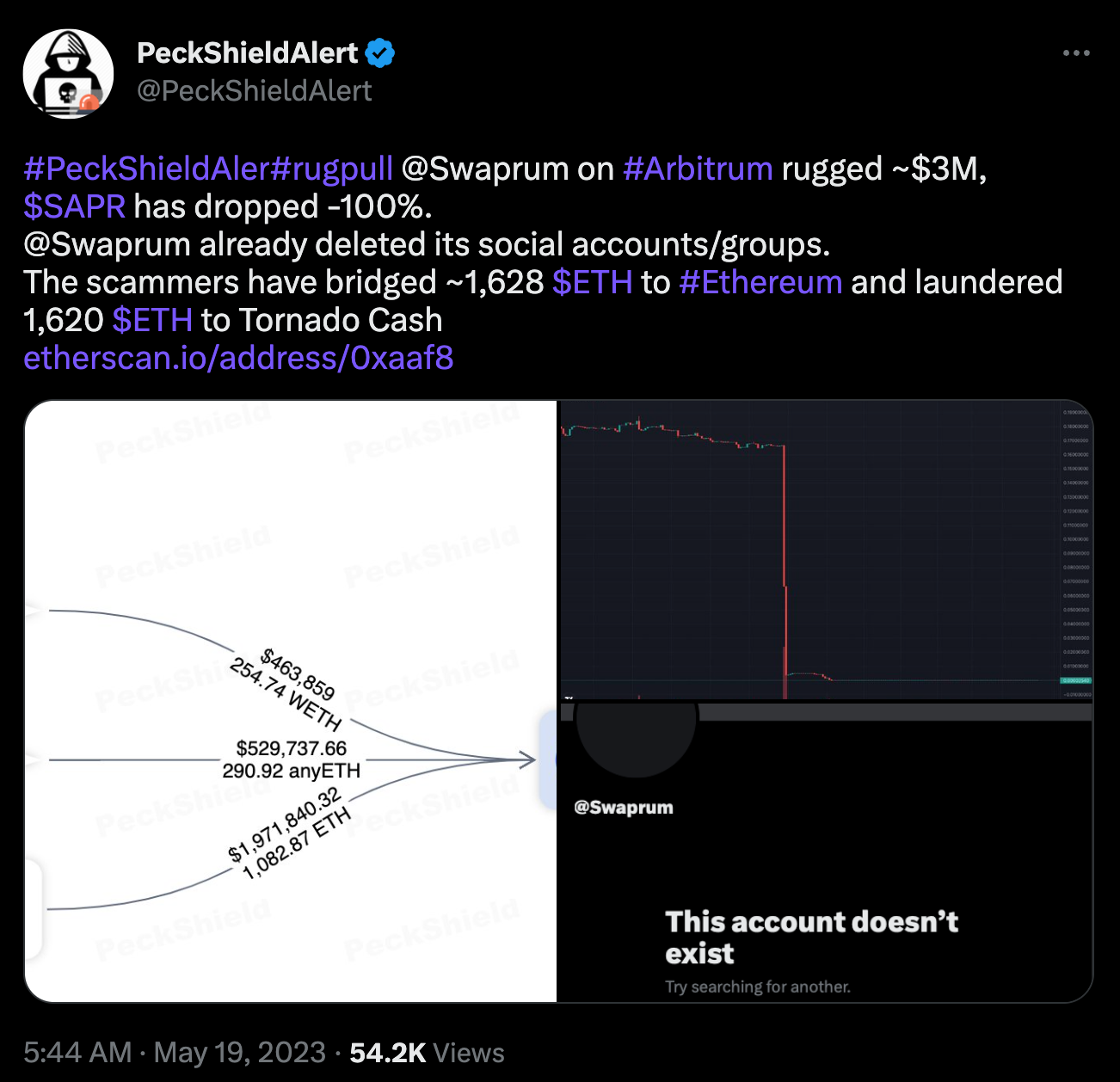

Swaprum, an Ethereum Layer 2 decentralized exchange on the Arbitrum network, allegedly absconds with user deposits, as PeckShield's on-chain analysis reveals approximately 1,628 ETH ($3 million) drained from Swaprum's liquidity pools.

Because Bitcoin

May 19, 2023

The Block reported that Swaprum, an Ethereum Layer 2 decentralized exchange operating on the Arbitrum network, has allegedly orchestrated an exit scam, commonly known as a "rug pull," resulting in the disappearance of an estimated $3 million in user deposits.

According to on-chain analysis conducted by PeckShield, approximately 1,628 ETH (equivalent to $3 million) was drained from Swaprum's liquidity pools. The fraudulent scheme involved the Swaprum team withdrawing the liquidity associated with the platform's native token on its exchange. Subsequently, the team sold the tokens in exchange for ETH, causing a significant drop in the price of Swaprum (SAPR) tokens and leaving investors with virtually worthless holdings.

To obscure the transaction trail and hinder potential tracing efforts, the funds were transferred from the Arbitrum network to Ethereum and then laundered through Tornado Cash, a renowned Ethereum mixing service. This series of actions aimed to obfuscate the origins of the ill-gotten ether and discourage authorities from tracking the funds.

Swaprum experienced a sudden disappearance of its digital presence, as its Twitter, Telegram, and GitHub accounts were deleted overnight. However, the project's official website, which served as the interface for its protocol, remains active. Despite attempts to reach out, The Block was unable to establish contact with the project for comment.

In a significant discovery, security analysts from Beosin uncovered a hidden backdoor functionality within Swaprum's smart contract. According to Beosin, the deployer of Swaprum utilized the add() backdoor function to illegitimately acquire LP tokens staked by users, subsequently profiting from removing liquidity from the pool. This malicious activity allowed the perpetrators to gain control over assets at their discretion.

Resources: